Achieve financial freedom by mastering investment strategies in volatile markets. Gain insights into effective investment tactics tailored for aspiring investors.

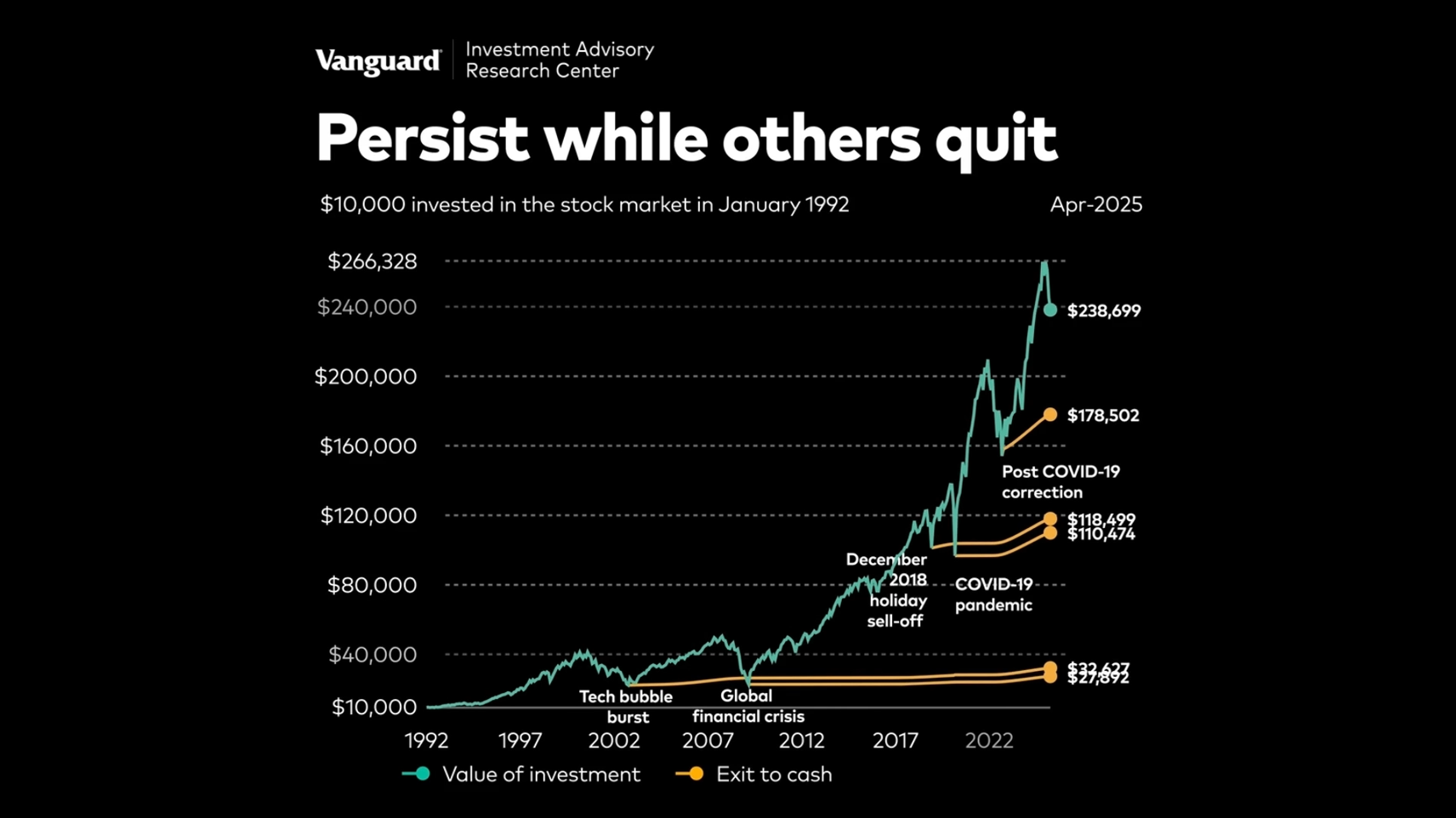

One way to help reach your financial goals? Persist when others quit.

Investing can be an emotional rollercoaster. Our feelings can pull us in different directions based on what the markets are doing, and these emotions can sometimes get in the way of making smart investment decisions.

When the markets are volatile, we may be tempted to make hasty decisions about our investments. But while economic events generate headlines, they shouldn't sway you to change your financial plan. History has proven the value of tuning out the noise and staying focused on your long-term goals—even in the most turbulent times. That's why—as this video shows—persistence is key.

Sources: Vanguard. Stocks are represented by MSCI US Broad Market Index through June 2, 2013, and CRSP US Total Market Index thereafter. Cash is represented by FTSE 3-Month U.S. Treasury Bill index; range is January 1, 1992 to April 08, 2025.

Notes: Hypothetical example. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Reaching your financial goals isn't about trying to outsmart the markets. It's about setting clear objectives, creating a long-term plan, and sticking to it, no matter what the market is doing. The best course of action is to be patient and disciplined, and stay focused on the long term.

So, the next time markets get volatile, take a deep breath and remind yourself why you started investing in the first place. Check in with your goals and your plan and make any necessary adjustments—but most importantly, stay the course. With patience and persistence, you can ride out even the toughest market swings and stay on track to achieving your financial goals.

Gain insights on market volatility from our experts