Navigate market volatility with confidence by exploring how optimal cash distribution could help portfolio stability and achieve your investment goals.

Smart cash allocation amid market volatility

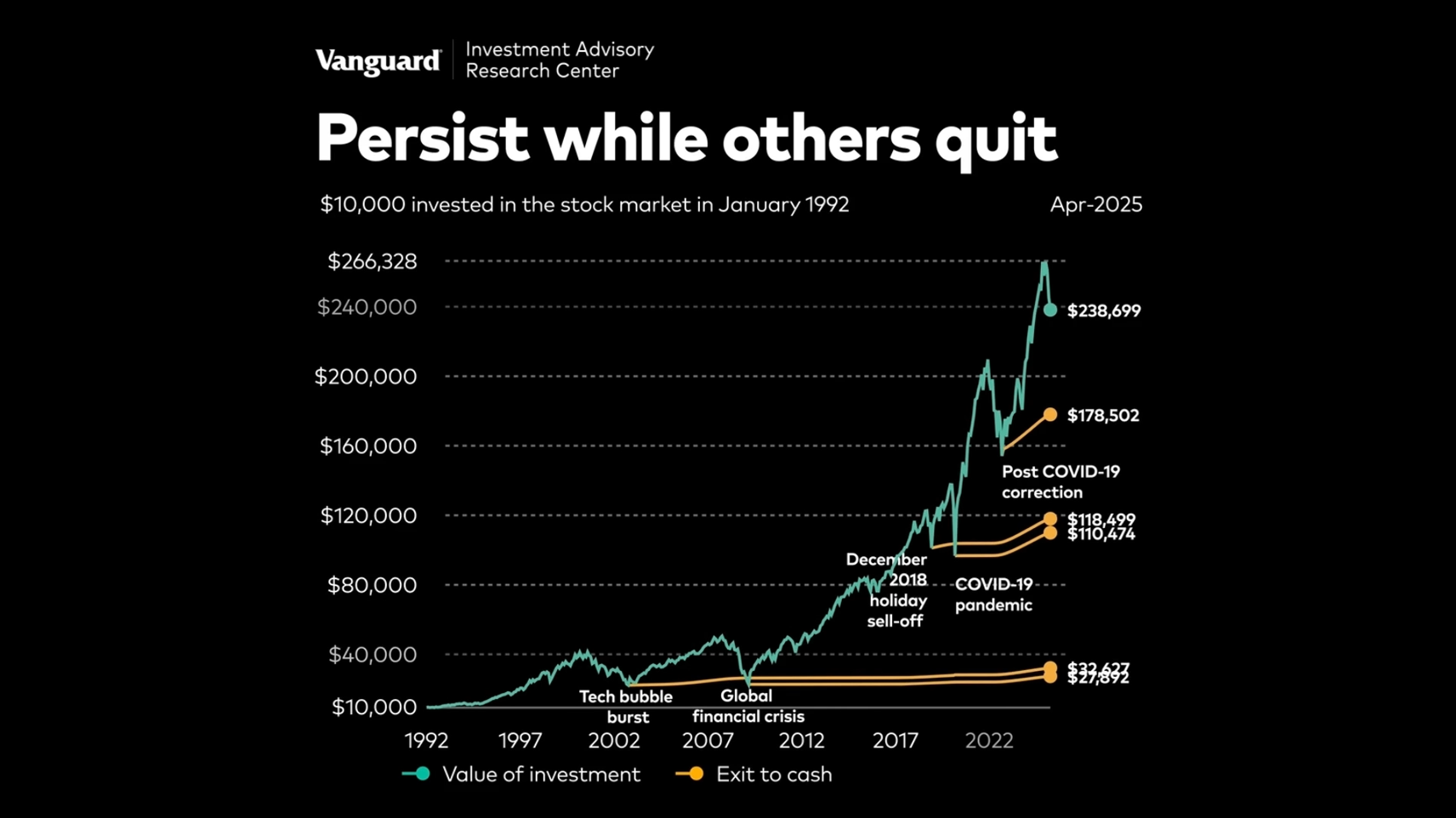

In times of significant market volatility, even the most seasoned investors may feel uneasy. It's natural to want to seek safety during turbulent times, and some investors are even tempted to shift some of their assets to cash. At Vanguard, we understand these concerns, but we believe that investors who "stay the course" and remain anchored to their long-term investment goals tend to have better outcomes over time.

Source: Vanguard. Stocks are represented by MSCI US Broad Market Index through June 2, 2013, and CRSP US Total Market Index thereafter. Cash is represented by FTSE 3-Month U.S. Treasury Bill index; range is January 1, 1992 to April 08, 2025.

NOTES: Hypothetical example. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Anchor your portfolio to your own goals

As the above graphic shows, making hasty or emotional investment decisions in response to day-to-day movements in markets may have negative long-term consequences. Even during market volatility, it's important that investors stay aligned to their personal goals.

But staying the course doesn't mean being complacent. There are steps you can take to ensure your assets are appropriately allocated, so you're better prepared to weather short-term market fluctuations while staying on track toward your long-term financial objectives.

If market volatility has you feeling anxious, consider your asset allocation and ask yourself if you have the right mix in place to achieve your goals and align with your personal risk tolerance. Remember that any changes you make shouldn't be based on emotions or in reaction to external events. Your investing decisions should be grounded in the goals you've identified and the time-tested asset allocations you've designated to help you reach them.

For example, when saving for a retirement goal, most investors start out with a greater percentage of equities (versus fixed income) in their portfolio. This can be a good strategy, especially early in your savings journey when you have many years to take on slightly more risk and benefit from the higher growth potential equities can provide. As you near retirement, you may prefer to have a higher allocation to fixed income, which can serve as a ballast for your portfolio during times of market volatility.

"Glide paths" are formulas that determine the optimal asset allocation of a fund based on an investor's expected retirement date. The allocation is designed to grow more conservative (higher allocation to fixed income, lower to equities) as you approach retirement.

A glide path toward retirement

What's the right role for cash?

Having access to some liquid assets is an important and enduring goal for investors, regardless of market conditions. What constitutes the "right" amount of cash will depend on your personal situation, considering any regular expenses, short-term spending plans, and the emergency fund amount that feels comfortable for you.

It's a good idea to periodically assess your emergency fund savings. Having ready access to cash is essential not just for everyday expenses, but also to cover spending or income shocks. A spending shock is any unanticipated but necessary expenditure, such as a car repair or a broken home appliance. An income shock would be a job loss or sudden reduction in income.

These things can happen to any of us, at any time, which is why maintaining an emergency fund is so important. If you don't have enough cash on hand when you need it, you might end up selling your investments in a down market, which can hurt your overall returns.

Vanguard research shows that having $2,000 in emergency savings is associated with 21% higher financial well-being. In addition, having at least 3 to 6 months of expenses saved is associated with 13% higher financial well-being.1

Investors who want to allocate more to the "cash" bucket in their portfolios should look to balance both yield and utility in making the best selection for their personal needs. When we talk about 'utility' in the world of cash investments, we're talking about how useful and practical an investment is for your everyday financial needs. Think of it like this: It's all about how well the investment helps you manage your money, access it when you need it, and even earn a little extra while keeping it safe.

When choosing a cash investment, think about what features and benefits are most important to you—like easy access, good returns, and peace of mind.

Finding smarter ways to save

We've established that cash plays an important role for all of us. Let's take the next step and think about where you should hold it. Not all cash and savings accounts are created equal. You want to make sure you're getting compensated for your cash. The fact is that most traditional bank savings accounts give you very little in returns.

Average APY on savings options

Sources: FDIC National Rates and Rate Caps and Vanguard, as of April 21, 2025.

The Vanguard Cash Plus bank sweep program APY is 3.65% as of April 21, 2025. The Cash Plus bank sweep program APY (annual percentage yield) will vary and may change at any time. Cash Plus bank sweep program APY is current as of date of publication. Current APY is available at https://investor.vanguard.com/accounts-plans/vanguard-cash-plus-account. The Vanguard Cash Plus Account is a brokerage account offered by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA. There may be other material differences between these products that must be considered prior to investing.

At Vanguard, we offer a variety of cash options to meet your specific needs.

Our Cash Plus Account features a bank sweep program with a competitive annual percentage yield (-% as of -)2 and FDIC coverage.3 Cash Plus also offers many features of a traditional checking or savings account, including an app with mobile check deposit, and account and routing numbers for paying bills online.4 You can keep your money in the bank sweep or diversify into 5 available money market funds.

Cash Plus can be a great choice for emergency savings, retirement living expenses, or other savings goals and needs. It gives you a lot of the same functionality as a traditional bank savings account—plus the option to invest in money market funds with the potential for higher returns. In that sense, Cash Plus can offer the best of both worlds.

Money market funds can make sense when you're looking for a safer investment with a compelling yield and you don't need the accessibility or functionality of a Cash Plus Account. Vanguard money market funds let you invest in low-risk assets like cash and Treasury bonds and seek to maintain a stable share price of $1. They require a minimum initial investment of $3,000. Unlike Cash Plus, money market funds are not FDIC-insured, and they don't have account or routing numbers, so they're less functional than a traditional bank account.

Vanguard also offers brokered certificates of deposit (CDs) with competitive yields and maturity options from 1 month to 10 years. CDs allow you to lock in an attractive interest rate, though you sacrifice some utility since you generally need to leave your money invested until the CD matures. (With Vanguard brokered CDs, you can sell early, but you may not receive the full principal value.)

Staying focused during market volatility

Vanguard has been working to help give investors the best chance for success for 50 years. Our enduring guidance is to stay focused on your long-term goals and stay committed to your investment strategy. We believe in the power of perseverance and encourage investors to make a plan for their asset allocation that they'll be able to stick to in all kinds of market weather.